Woodside 1Q24 results | Climate Transition Analysis

Woodside released its 1Q24 results last week with no disclosure provided for its New-Energy segment.

Our view

To deliver on decarbonisation, Woodside's transition strategy must move away from the sidelines, where targets are aspirational and highly contingent. For its transition strategy to be credible, investors should engage on these material gaps:

1) Reliance on offsets: We estimate offsets will account for ~70% of total emissions reductions between Woodside’s FY16-20 baseline and FY30.

2) Rising scope 3 emissions: Woodside’s transition strategy does not address its growing customer scope 3 emissions, with production growing 16% to FY27.

3) Unclear value for decarbonisation: Investment must grow 26% on average to meet its $5bn aim, and the proposed 5Mtpa of emissions avoided or abated translates into an expensive and small opportunity.

4) Emissions targets are not comprehensive, addressing just 8% of emissions.

Key takeaways

-

Yesterday, Santos revealed new quarterly capex disclosures for its Santos Energy Solutions segment in its Q1 results. However, we did not see the same from Woodside, who lacks quarterly disclosures for New Energy.

Woodside must significantly ramp up investment to reach its $5bn cumulative target by FY30. We estimate annual low carbon capex will need to grow 26% p.a to achieve this goal.

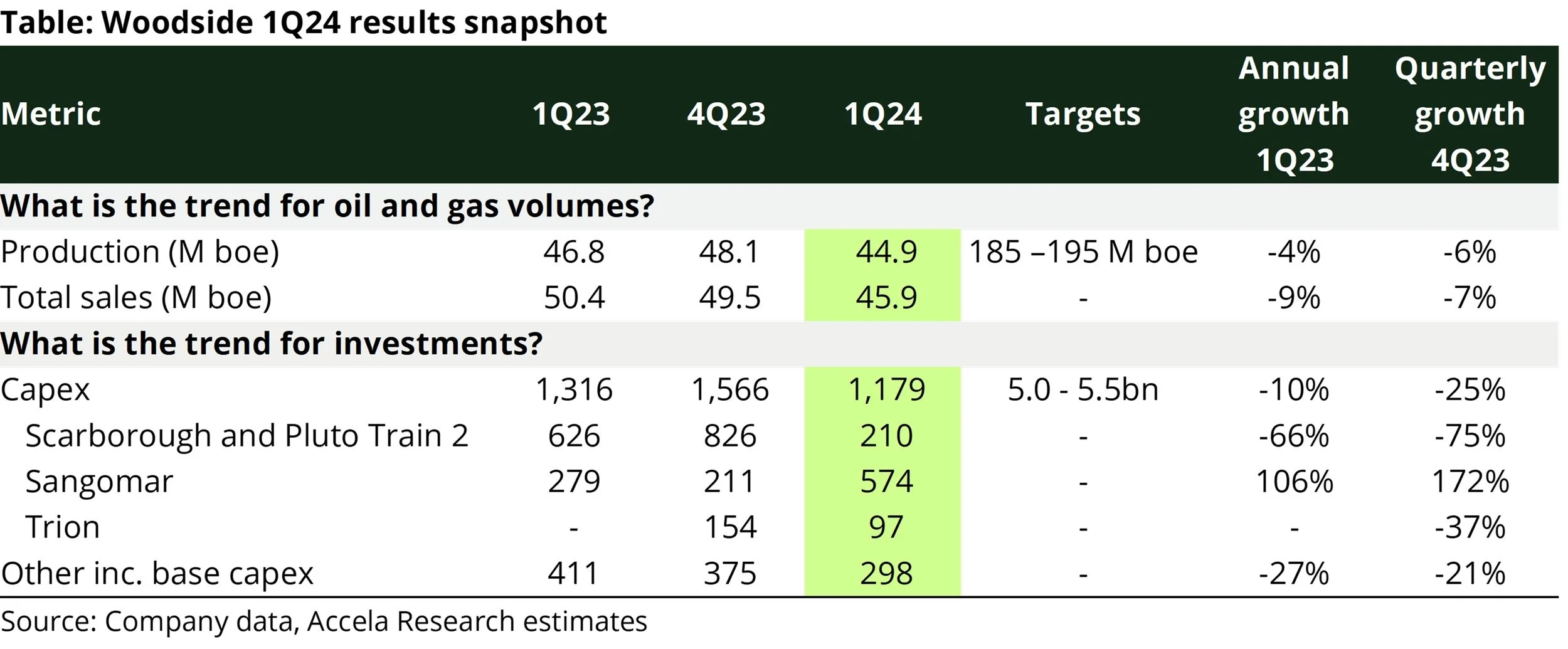

Group capex was down 10% from 1Q23 to $1.2bn, with the company confirming FY24 guidance of $5 - 5.5bn.

-

Revenue fell 31% from 1Q23 to 1.4bn. The company cited lower realised prices, with prices from LNG production falling 38% from 1Q23. Almost 50% of the revenue decline comes from Woodside’s North West Shelf operations.

Production fell 4% from 1Q23 to 44.9 M boe, due to lower production at Bass Strait, Pyrenees and Pluto.

-

Woodside's H2OK hydrogen project in Oklahoma continues to face delays due to guidelines on US IRA tax credits. Instead of building out its own renewables, the project draws power from the grid, calling into question the project’s IRA eligibility.

Woodside expects to receive final guidelines in the second half of FY24. To date, only one project, H2 Perth, has reached FID, (<0.1% of hydrogen pipeline).