Santos 2Q24 & 1H24 Results | Climate Transition Analysis

This report comprises general statements of factual information and not financial advice. Read our Important Notice.

UPDATE: Santos 1H24 results - 21 August 2024

1H24 results provided more information on Santos' financials and performance, with no new details on emissions performance.

Key takeaways:

01

Weaker financial performance was evident in 1H24 despite growth in dividends, with Santos reporting an underlying profit of $654m, down 18% from 1H23. EBITDAX* fell 13% to $1.85bn. This was driven by a 95% decline in the Northern Australia and Timor-Leste segment ($3m) due to lower Bayu-Undan production and a 16% decline in PNG EBITDAX ($1bn) due to weaker commodity prices.

Net debt rose 17% to $4.8 billion, while free cash flow declined 5% to $1.1bn. Notably, interim dividends surged 49% to a record $422 million.

02

Santos Energy Solutions posted a 14% drop in EBITDAX to $102m, noting that all revenue comes from midstream tolling of third-party gas, with no contributions yet from low-carbon as it develops its CCS offerings.

Bayu-Undan CCS FEED is 86% complete, targeting FID in 2025. The facility is expected to store ~10 Mtpa of CO2 annually from both Santos and third-party sources.

03

Upstream earnings struggled, with EBITDAX declining 12% to $1.8bn. Higher unit production costs (excluding Bayu-Undan) rose 4% to $7.94/boe due to maintenance timing and extreme weather.

The FY24 outlook remains unchanged with sales volume guidance at 87-93 MMboe and production guidance at 84-90 MMboe.

*Santos defines EBITDAX as earnings before interest, tax, depreciation and depletion, exploration and evaluation expensed, impairment and change in future restoration assumptionsSantos 2Q24 results - 18 July 2024

Santos’ 2Q24 results provided little detail on decarbonisation. With 1H24 results around the corner, we hope to see more information on their strategy and progress.

Our view

Santos is solely relying on CCS technologies as a revenue source for its low-carbon offerings. With Moomba CCS nearing completion, the company has yet to provide an indication of earnings investors can expect to see from the provision of CCS as a service.

Investors engaging with Santos should ask for:

1) Quantification of the overall cost, earnings and emission implications of producing synthetic methane and providing carbon capture services.

2) Plans to monitor the effectiveness of its Moomba CCS project and how potential liabilities will be managed should it fail to capture all emissions from external sources.

3) The alternative transition strategies Santos could consider if it cannot build a significant and viable proposition for fossil-based fuels (synthetic methane) and CCS as a service.

4) Provide emissions disclosure on a financial year basis to align with financials.

Key takeaways

-

In its latest result, Santos announced Moomba is 92% complete with injection set to ramp up in the second half of 2024. While the company also announced the completion of a study on a CCS pipeline to transport CO2 it has yet to provide a view of its feasibility.

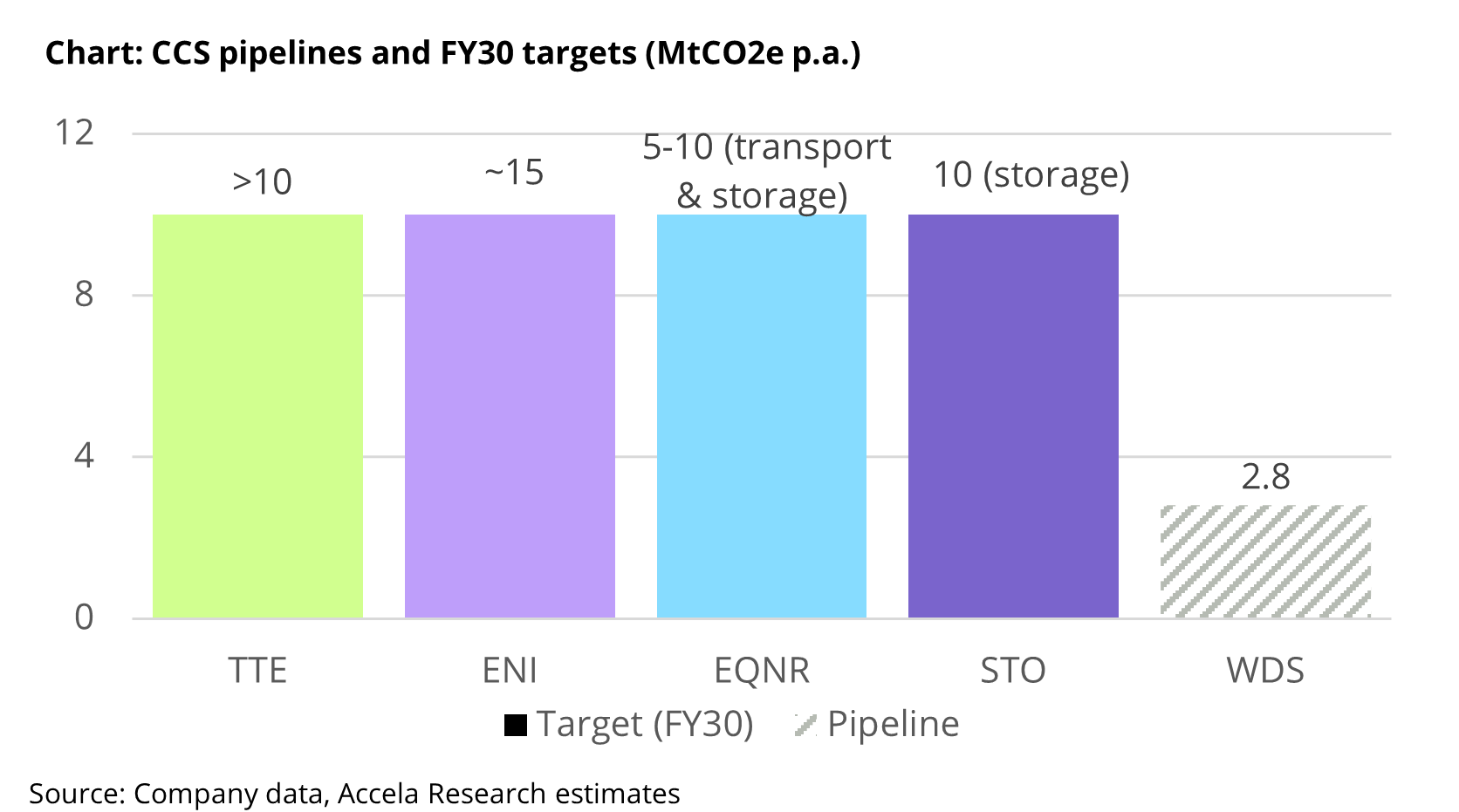

Despite being significantly smaller in size, Santos’ CCS ambitions are in line with European majors, with the company guiding to 10 Mtpa of storage by 2030. Over the next year, the effectiveness of Moomba will be critical in proving Santos’ capability in delivering a large scale CO2 storage service at a low-cost. Furthermore, Santos has yet to disclose details on customers and commercial viability of the offering.

No updates were provided on Santos’ e-methane offering.

-

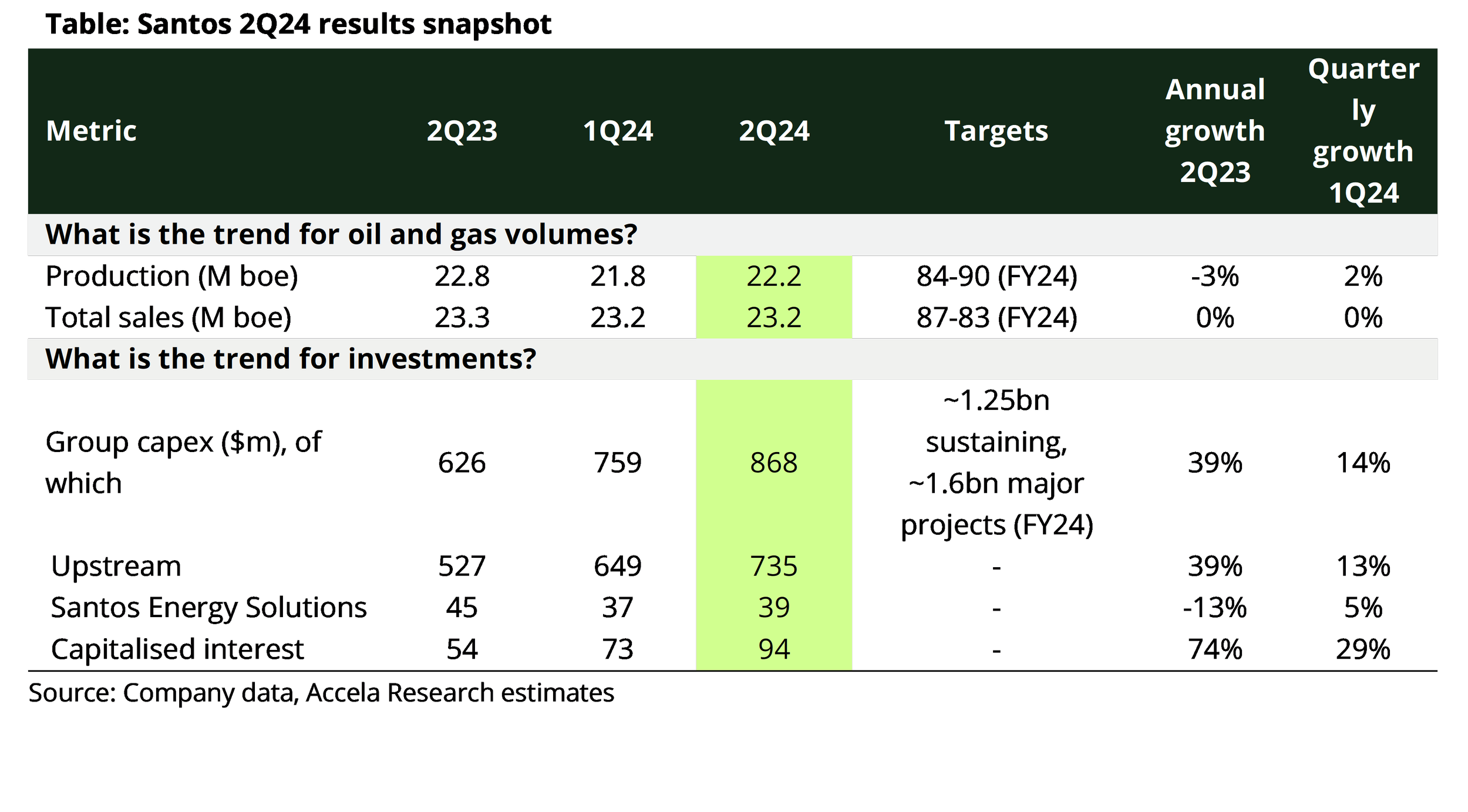

This is now the second quarter of Santos reporting capex for its Santos’ energy Solutions. Low-carbon capex was $39m down 13% on 2Q23. This drop was due to reduced capex in WA where the Reindeer CCS project is still in FEED stage. On the other hand, group upstream capex was up 39% on 2Q23, with capex in WA being the main driver for the increase (+163% on 2Q23).

As of 1H24, Santos’ invested 5% of capex in Energy Solutions.This will need to rise to an annual average of 24% between FY24-FY33, to meet Santos’ $3-4.5bn cumulative capex ambition.

-

Revenue fell 6% from 1Q24 to 1.3bn, due to lower LNG and crude oil volumes offset by higher prices.

Production fell 3% from 2Q23 to 22.2 M boe, but was up 2% from 1Q24 due to recovery from weather outages in the Cooper basin and planned maintenance in LNG.

Company free cash flow was the lowest reported in the last 8 quarters at $380 m.