Shell’s Energy Transition Update 2024

“Shell finally has a climate plan aligned with its corporate strategy, lowering its Net Carbon Intensity targets as we expected.

It is still missing critical elements of a credible transition plan, with high use of offsets increasing 5x from 2022 to 20Mt, and remuneration incentives for transition watered down.”

Shu Ling Liauw

CEO, Accela Research

Shell Energy Transition update, underwhelming rebase

Shell released its 2024 Energy transition plan today. What surprised us most was how little has changed.

The tweaks made to lower the Net Carbon Intensity target (and removal of the FY35 target) might seem like a big move backward, but as our analysis has shown, this was never achievable with the current strategy. For those doing the numbers, it was expected.

What was new?

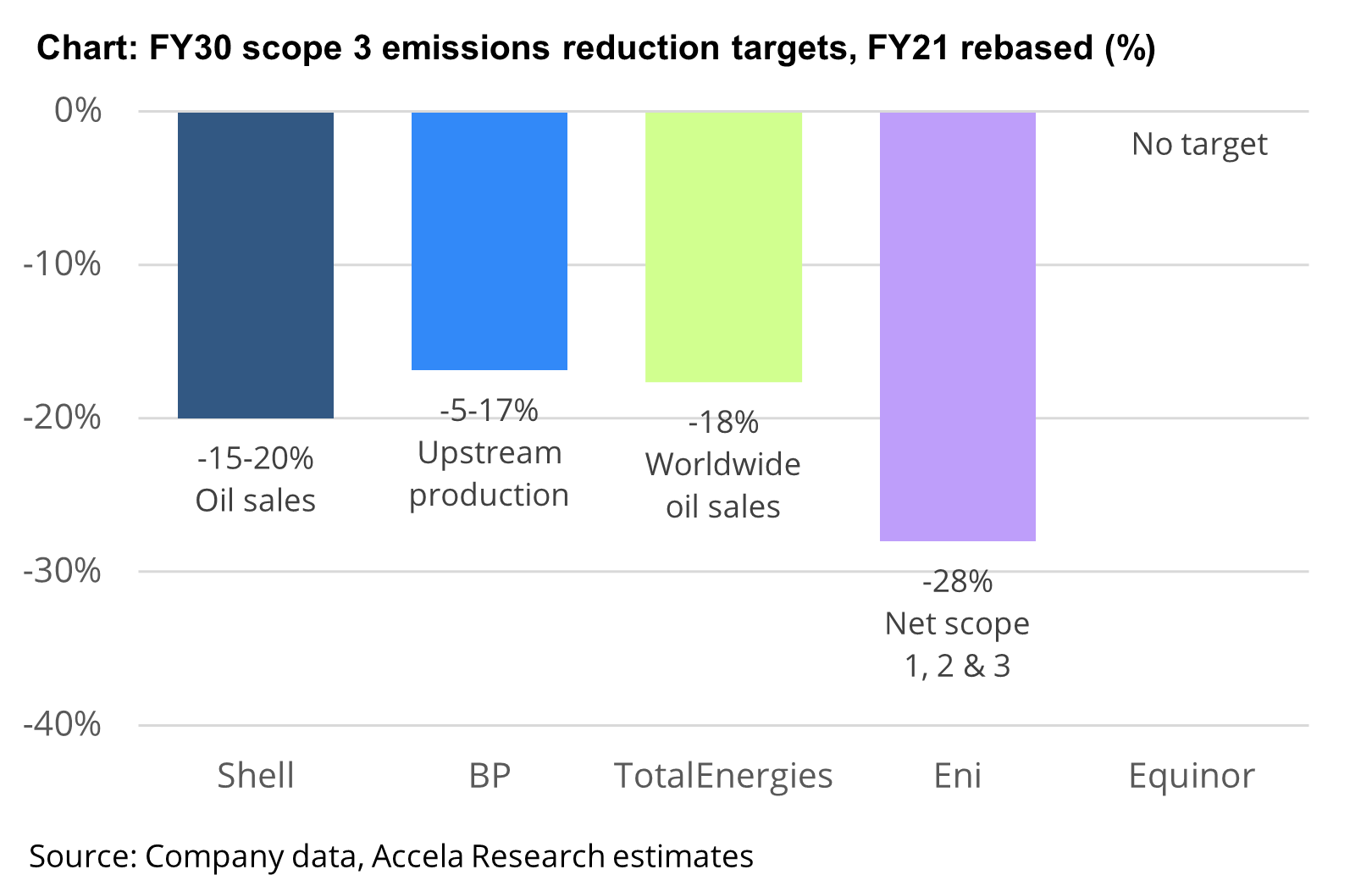

Shell has a new scope 3 target for oil sales, targeting a 15-20% reduction between FY21-30. However, oil production guidance was unchanged (stabilising at 1.4 Mboe/d to FY30), signaling no change to production ambitions, but with some intention to reduce oil sales, replacing some of it with growing gas.

Shell’s new target is broadly aligned to TotalEnergies, when rebasing to the same year (-40% between FY15-30, and -18% between FY21-30) and with the oil demand outlook under the IEA Announced Pledges Scenario (-9% between FY23-30).

It was good to see Shell provide more visibility on its outlook for FY30 emissions from oil sales and its expected energy portfolio mix, with oil reducing in contribution from 48% to 39%.

Our view:

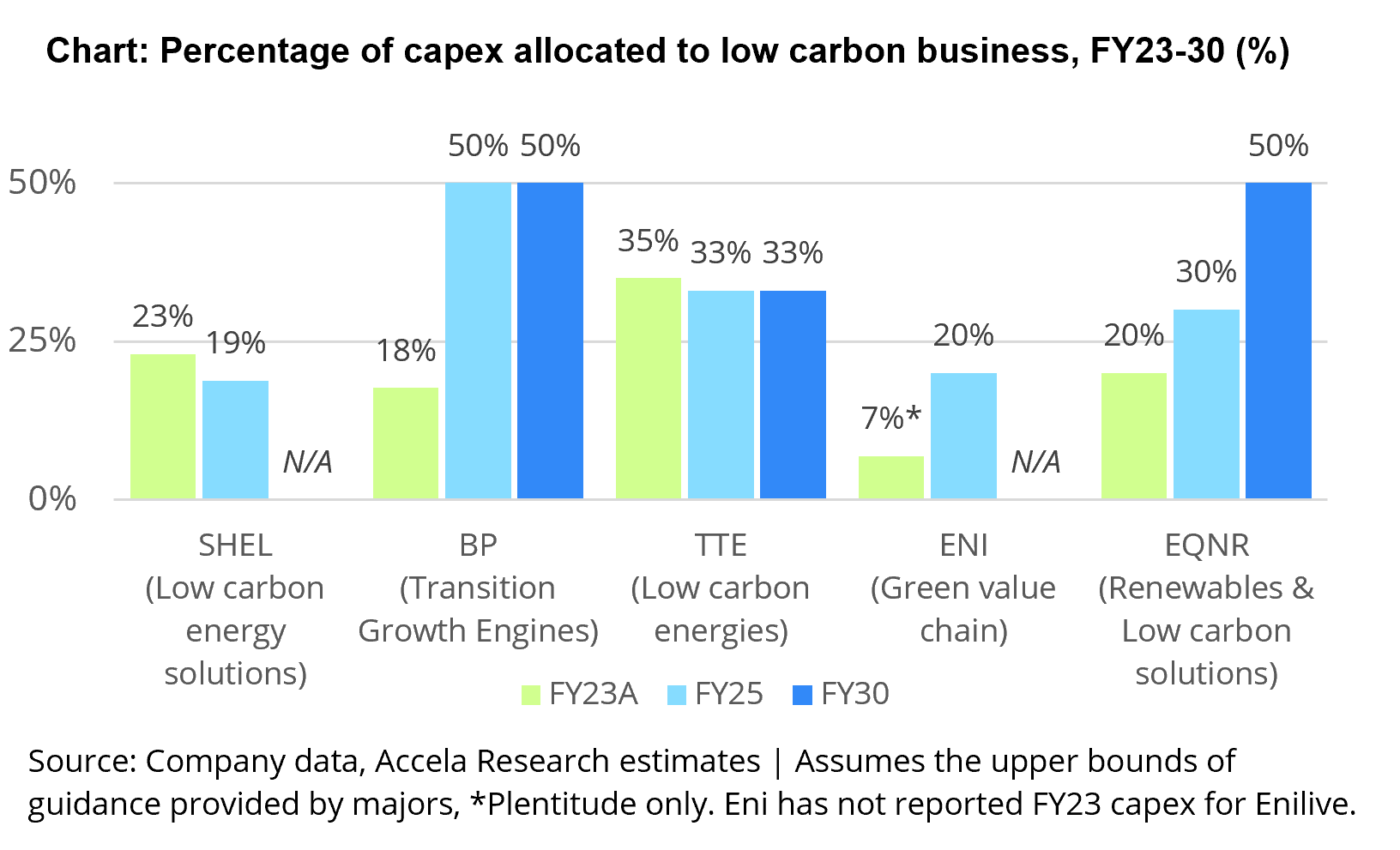

Shell's transition strategy is still missing critical elements, trailing peers in its FY25 target for energy transition capex and no guidance for FY30, high use of offsets increasing 5x from FY22 to 20 Mt, and remuneration incentives for energy transition now incentivising expansion of fossil fuels.

Key takeaways:

-

In FY23, Shell’s total net emissions reduced 55 Mt (4%), with over 1/3 coming from offsets.

Relative to FY30 targets, Shell scope 1 and 2 declined 31% (-50% target), NCI reduced 6.3% (-15-20% target), and scope 3 from oil sales declined 9% since FY21 (-15-20% target).

Surprisingly, offsets increased 5x to 20Mt, 12% of the total offset market retired globally in 2023 (164 Mt offsets retired by companies in 2023*).

Its strategy on offsets appears unchanged from 2021 despite the company distancing itself from its prior lofty target of 120 Mt pa of offsets by FY30 (equivalent to a fully mature forest covering an area the size of the UK).

Divestments continue to be called out as a lever for future emissions reduction.

*BloombergNEF, 2024

-

Shell’s levers for its low-carbon business remain unchanged, with a focus on growing its EV network and biofuels and shifting its power segment to focus away from retail to commercial customers.

Low carbon energy solutions capex was reiterated at $10-15 bn over FY23-25 (implies $2.2-4.7bn pa. for FY24-25). We were disappointed to see no additional guidance beyond FY25.

Shell, along with Eni lags peers on the percentage of capex it plans to allocate to low carbon in FY25 at ~20% (BP ~50%, TotalEnergies 33%).

To FY30, the company indicated its estimated share of energy sales would be 39% oil (9% lower than FY23), 26% LNG, with the remainder ~35% being pipeline gas, electricity and biofuels.

FY30 EBITDA guidance for the transition business was not mentioned, but we assume the guidance provided in the 2023 Capital Markets day remains unchanged. Low carbon fuels ($1-2bn), EVs ($1-1.5bn), Power & hydrogen (>$3bn).

-

Oil production guidance was reiterated and is expected to be flat to FY30 (~1.4 Mboe/d).

LNG targets were unchanged, aiming to grow capacity by 11 Mtpa in the second half of the decade, growing sales 20-30% by FY30.

There was no change to oil and gas capex, $40bn between FY23-25, consistent with FY24-25 guidance provided for the individual segments (~$8bn p.a Upstream, $5bn Integrated Gas).

-

The board revised the energy transition performance metrics included in remuneration.

Shell’s LTIP, 25% weighting for energy transition, no longer includes a metric on its NCI target, focusing on scopes 1 and 2 (FY30 target) and methane.

Its annual bonus scorecard, 15% weighting for energy transition, has removed a target for selling lower carbon products (which was not met in FY23) and replaced it with a target for increased equity LNG.

While Shell has always focused on growing its LNG, shareholders will be surprised to see that remuneration linked to energy transition is incentivised by the expansion of fossil fuels.

Summary of changes to Shell’s Energy Transition Strategy

| Target | Prior | 2024 |

|---|---|---|

| Total emissions | "We believe our total absolute emissions have peaked in 2018 at 1.73 GtCO2e" | Unchanged, Reiterated in Energy Transition Strategy (p10) |

| Scope 1 and 2 emission targets |

FY30: -50% FY50: Net zero |

Unchanged, Progress FY23: -30% rel. to 2016 (incl. offsets) |

| Net Carbon Intensity target |

FY30: -20% FY35: -45% FY50: -100% |

FY30 NCI target declined to 15-20% Removed FY35 target Progress FY23: -6.3% (incl offsets) |

| Scope 3 target |

FY30:Nil |

New: Scope 3 oil products, 15-20% by FY30 (FY21 base year), 9% acheived to date |

| Cash capex - Low carbon energy solutions | $10-15bn FY23-FY25 (implies $2.2-4.7bn pa. for FY24-25) | Unchanged |

| Production guidance: | ||

| Oil FY30 | Oil production reiterated to be flat to FY30 (~1.4 Mboe/d). | Unchanged |

| Gas FY30 | Not specified | Not specified |

| LNG FY30 | LNG capacity guided to grow 11 Mtpa by FY30 | Unchanged |