Santos 2024 Investor Day | Climate Transition Insight

Santos’ investor update reflects progress in scaling back aggressive production targets. However, its strategy is now firmly locked in on oil and gas under its new capital allocation framework, while doubling down on CCS services as its sole meaningful transition offering with a new 14 Mtpa third-party storage target by FY40.

Santos’ FY24 production, unit cost, and capital expenditure guidance remain unchanged. The company will provide 2025 guidance in its 4Q24 report in January 2025

Our view:

Santos’ strategy is reliant on CCS as its primary low-carbon lever, with limited progress on diversifying revenue streams or addressing its significant scope 3 emissions. The company has yet to indicate earnings investors can expect from the provision of CCS as a service and the sale of generated ACCUs.

Priority questions ahead of 2025:

01 Quantification of levers to decarbonise:

What alternative transition strategies will Santos pursue if it cannot establish a viable business case for fossil-based fuels like synthetic methane and CCS as a service? Given these solutions are central to Santos’ strategy, what is the contingency plan if they fail to scale commercially or meet emissions targets?

Will Santos commit to aligning emissions reporting with its financial year to improve clarity? The current July-June emissions reporting cycle creates misalignment with calendar year financials, hindering consistent analysis.

02 Increases in low-carbon investment:

Can Santos quantify the total cost, earnings potential, and emissions implications of producing synthetic methane and offering carbon capture services? Investors need clarity on whether these initiatives justify investment and align with long-term decarbonisation goals.

What measures will Santos take to monitor and manage potential liabilities if the Moomba CCS project underperforms? Given that the project is expected to capture emissions from external sources, what safeguards are in place should it fail to deliver the intended results?

Key takeaways:

-

Santos lowered its medium-term production target by nearly 15% to 100-120 mmboe by 2027, remaining above 100 mmboe annually thereafter. This represents a more measured approach compared to its earlier 100-140 mmboe ambition, which is a positive development.

However, the update confirms Santos’ long-term commitment to sustained oil and gas production beyond 2030, locking in fossil fuel reliance with no credible pathway to reduce its emissions.

-

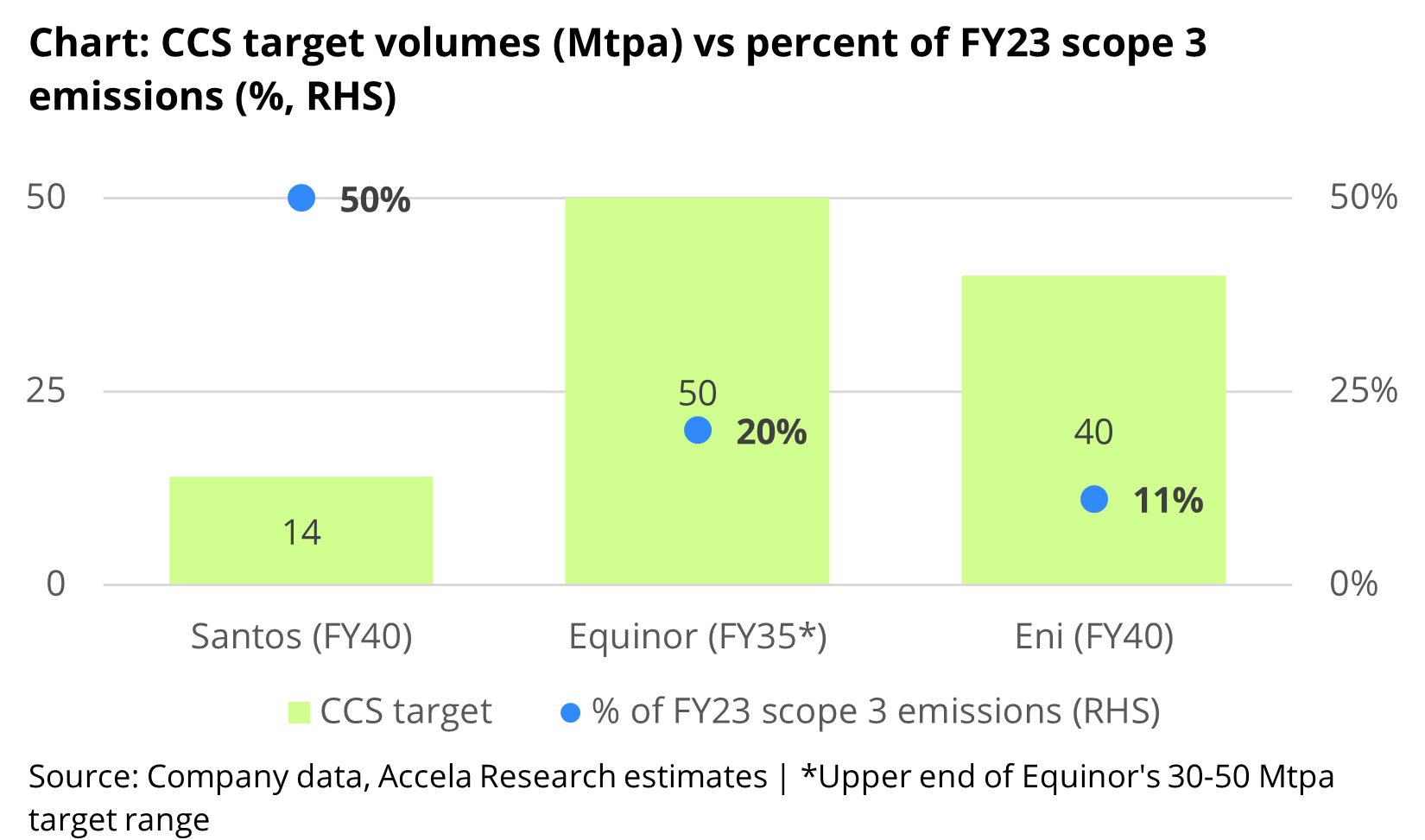

Santos announced a new carbon storage target of 14 MtCO₂e annually by 2040, equivalent to 50% of its 2023 scope 3 emissions from the combustion and use of sold products.

This ambition mirrors targets from larger European peers like Equinor, which plans to store 30-50 MtCO₂e annually by 2035, equating to just 10-20% of its scope 3 emissions.

Unlike Equinor, which has a 26 GW renewables pipeline, Santos does not have other options in transition outside nacent talk of e-methane and will be reliant on CCS, green hydrogen availability, and cross-boarder economic and regulatory frameworks.

This raises concerns about double counting emissions reductions and leaves its significant scope 3 emissions from fossil fuel combustion largely unaddressed.

-

Santos’ capital allocation strategy prioritises shareholder returns, committing at least 60% of ‘all-in’ free cash flow (operating cash flows less investing cash flows net of acquisitions and disposals) from 2026. This will increase up to 100% when 15-25% gearing targets are met.

This will be underpinned by the introduction of a capex ‘ceiling’, which will constrain annual sustaining and development capital expenditure

While its good to see Santos favouring "value over volume" in oil and gas, the introduction of a capex ceiling limits spending across its portfolios, including Santos Energy Solutions. This restricts investment in diversifying future low-carbon projects and reinforces Santos’ dependence on its existing oil and gas operations for long-term profitability.